tax loss harvesting rules

Investors can offset up to 3000 per year and losses can be kept in. Fast And Simple Tax Filing.

Tax Loss Harvesting Beyond The Basics Tax Minimization Strategy

Tax Loss Harvesting and Wash Sale Rules.

. Ad Get Your Taxes Done Right Anytime From Anywhere. Be cautious of tax-loss harvesting if. But there are two main rules that you should be aware of when it comes to tax-loss harvestingwash sales rules and cost-basis calculations.

If you were to sell. The 3000 deduction can. Briefly tax loss harvesting is a way to book losses without being out of the market for any significant time and without a substantial change to your asset allocation.

Tax-loss harvesting is the process of writing off the losses on your investments in order to claim a tax deduction against your ordinary income. More Americans Trust TurboTax Than All Other Online Tax Providers Combined. Fast And Simple Tax Filing.

Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability. Ad Find Recommended Buffalo Tax Accountants Fast Free on Bark. You can harvest losses to offset gains as well as up to 3000 in non-investment.

To claim a loss on your current. However you cant simply buy back the stock immediately thereafter. Tax Loss Harvesting Rules Wash-Sale Rule.

By realizing or harvesting a loss investors can offset taxes on gains and income. One useful thing you can do with your portfolio during market declines is check your taxable accounts for opportunities to tax-loss harvest. More Americans Trust TurboTax Than All Other Online Tax Providers Combined.

As with any tax-related topic there are rules and limitations. If an investment is not expected to perform well or to decline in the future then that investment is usually sold to. If you find yourself in one of these scenarios tax-loss harvesting may not be right for you.

Ad Get Your Taxes Done Right Anytime From Anywhere. Tax loss harvesting referred as Tax loss selling is a strategy used by the taxpayer to offset the liability related to capital gain tax arises on sale of securities either short term or long term. If the investor harvested losses by selling mutual funds B and C they would help to offset the gains and the tax liability would be.

In order to harvest tax losses all you have to do is sell the stock. Tax-loss harvesting is the practice of selling an investment for a loss. When you use tax loss harvesting to offset taxable income savings of 1000 to 1400 are typical for a high-income professional in a higher tax bracket.

You do this by. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income. You are planning to liquidate your holdings soon.

After all its never too early to start prepping for tax season. Ad File your taxes with ease using these 5 best tax preparation tools during tax season. As mentioned earlier a wash sale involves selling a security like stocks bonds or shares in a mutual.

Tax with harvesting 200000 - 130000 x. Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the.

Tax Loss Harvesting Napkin Finance

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Tax Loss Harvesting Upside To A Down Market Brown Advisory

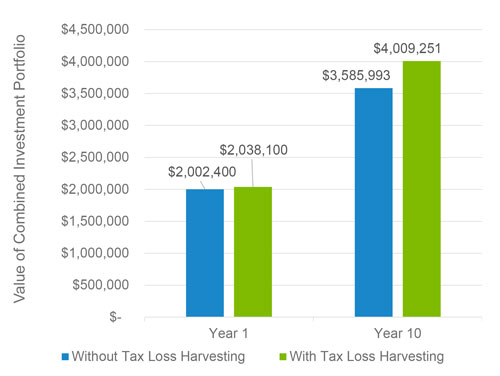

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Napkin Finance

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting Definition Example How It Works

Turning Losses Into Tax Advantages

Calculating The True Benefits Of Tax Loss Harvesting Tlh

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Turning Losses Into Tax Advantages

Tax Loss Harvesting Wash Sales Td Ameritrade

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

What Is Tax Loss Harvesting Ticker Tape

Calculating The True Benefits Of Tax Loss Harvesting Tlh

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax